Key takeaways

- Cango (NYSE: CANG) sold 4,451 BTC (around 60% of its reserves) for roughly $305 million.

- The sale was executed on the open market for USDT at around $68,000 per BTC.

- Proceeds were used for a partial repayment of a loan collateralized by bitcoin, aiming to reduce debt load.

- Reserves fell from ~8.1k BTC to ~3.6k BTC; the company now ranks 26th among public BTC holders.

- The company announced a shift toward AI computing and building a global distributed computing infrastructure.

What happened

Mining company Cango (NYSE: CANG) sold 4,451 BTC over the past weekend,

cutting its bitcoin reserves by roughly 60%. The sale was carried out on the open market for

USDT at around $68,000, totaling approximately $305 million.

Cango logo (NYSE: CANG).

How reserves changed

According to BitcoinTreasuries, from February 6 to February 9 Cango’s reserves declined

from ~8.1k to ~3.6k BTC. The miner now ranks 26th

among the largest public bitcoin holders.

Why Cango sold BTC

Cango directed the proceeds toward partial repayment of a bitcoin-collateralized loan. The board approved the sale

after reassessing market conditions, seeking to reduce the company’s debt burden.

Ties to Bitmain and global farm footprint

Cango, previously among the top-3 miners by deployed capacity, is closely linked to Bitmain

(the largest ASIC miner manufacturer) through equipment supply and financing structures. The company operates

more than 40 farms across North America, the Middle East, South America, and East Africa.

Illustration: Antminer ASIC miner. Source: Wikimedia Commons (CC BY-SA 2.0).

Current metrics

According to the official website, Cango’s operating hashrate is 37 EH/s. In January 2026,

the company mined 496 bitcoins.

Business model transformation: a pivot to AI

After announcing the sale, Cango published a shareholder letter outlining a business model transformation.

The company is shifting from traditional mining to becoming an operator of global distributed computing infrastructure

designed to support artificial intelligence workloads. Cango plans to develop modular compute nodes,

introduce proprietary software solutions for capacity management, and gradually evolve into a platform providing

AI compute worldwide.

Illustration: server racks (data center/compute). Source: Wikimedia Commons (CC BY 2.0).

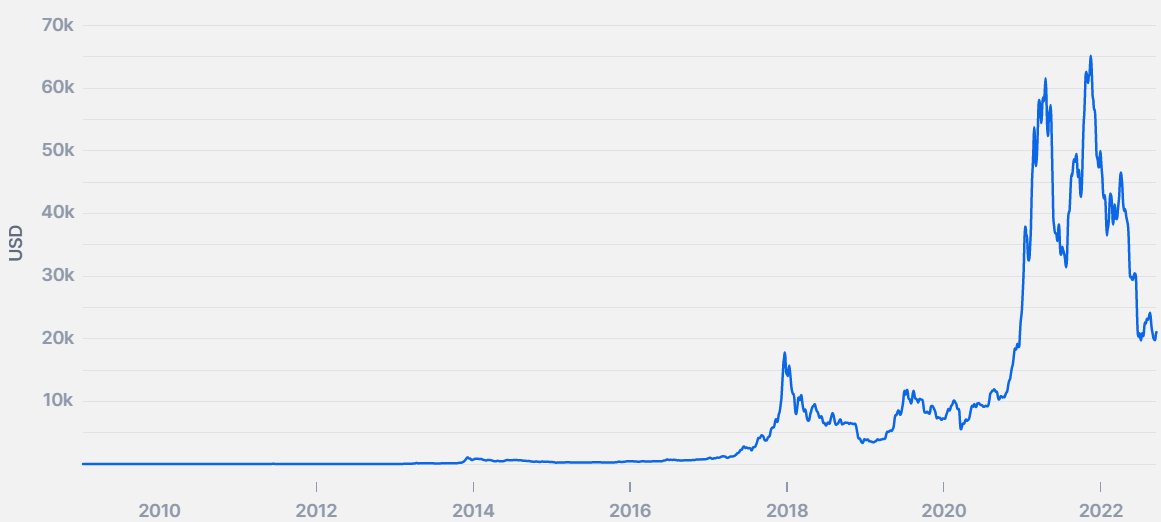

Market context: miners are selling reserves

Against the backdrop of declining mining profitability driven by bitcoin’s price drop, many miners are forced to sell crypto

to cover operating costs or meet liabilities. For example, last week one of the largest mining companies, MARA,

transferred crypto worth $87 million to exchanges.

Illustration: BTC price chart. Source: Wikimedia Commons (CC BY-SA 4.0).

Key figures (single table)

| Metric | Value |

|---|---|

| BTC sold | 4,451 BTC |

| Estimated sale price | ~$68,000 per BTC |

| Deal size | ~$305 million |

| Converted into | USDT |

| Reserves before (Feb 6–9) | ~8.1k BTC |

| Reserves after (Feb 6–9) | ~3.6k BTC |

| Reserve reduction | ~60% |

| Rank among public holders | 26th place |

| Purpose of the sale | partial repayment of BTC-collateralized debt |

| Operating hashrate | 37 EH/s |

| BTC mined in January 2026 | 496 BTC |